MicroStrategy announced this week plans to issue $600 million in convertible senior notes due in 2030, targeting qualified institutional buyers. This move, subject to market conditions, could see an additional $90 million in notes offered shortly after the initial issuance. The notes, set to mature on March 15, 2030, will pay interest semi-annually and may be converted into cash, MicroStrategy’s class A common stock, or a mix of both, under certain conditions. MicroStrategy says it aims to use the proceeds from this offering to purchase more Bitcoin.

With a war chest of 190,000 Bitcoin MicroStrategy is sitting on an unrealized profit of almost $4 billion, but CEO Michael Saylor says the company has no plans to sell its Bitcoin. “I’m going to be buying the top forever. Bitcoin is the exit strategy,” Saylor recently told Bloomberg. The outspoken Bitcoin bull said that Bitcoin is “technically superior” to gold, the S&P 500, and real estate.

“Bitcoin has just emerged as a trillion-dollar asset class, and it’s alongside, uh, names like Apple and Google and Microsoft. But the difference between Bitcoin and the magnificent seven is Bitcoin’s an asset class. It’s not a company. There’s not enough room in the capital structure of those companies to hold 10 trillion or a hundred trillion dollars worth of capital. So Bitcoin’s competing against gold, which is 10X what it is right now, it’s competing against the S and P index. It’s competing against real estate, a hundred trillion dollars plus asset class as a store of value. So we believe capital’s going to keep flowing from those asset classes into Bitcoin because Bitcoin is technically superior to those asset classes and that being the case, there’s just no reason to sell the winner to buy the losers.”

Indeed, according to research from Buy Bitcoin Worldwide Saylor continues to be a buyer, rather than a seller – making the following large Bitcoin buys since the start of November last year.

- 11/01/2023 – 155 Bitcoin for $5.3 million

- 11/30/2023 – 16,130 Bitcoin for $593.3 million

- 12/27/2023 – 14,620 Bitcoin for $615.7 million

- 02/06/2024 – 850 Bitcoin for $37.2 million

MicroStrategy’s Bitcoin treasury

MicroStrategy did not purchase any Bitcoin last October. Prior to that the company disclosed its acquisition of approximately 5,445 bitcoins between August 1, 2023, and September 24, 2023. The acquisition, involving MicroStrategy and its subsidiaries, amounted to approximately $147.3 million in cash, with an average price of approximately $27,053 per bitcoin, inclusive of fees and expenses.

As of September 24, 2023, MicroStrategy and its subsidiaries held an aggregate of approximately 158,245 bitcoins. These were acquired at an aggregate purchase price of approximately $4.68 billion, with an average purchase price of approximately $29,582 per bitcoin, inclusive of fees and expenses.

Additionally, MicroStrategy has entered into a Sales Agreement with Cowen and Company, LLC, Canaccord Genuity LLC, and Berenberg Capital Markets LLC. Under this agreement, MicroStrategy may issue and sell shares of its class A common stock, having an aggregate offering price of up to $750.0 million. As of September 24, 2023, MicroStrategy has issued and sold an aggregate of 403,362 Shares under the Sales Agreement, yielding net proceeds of approximately $147.3 million, less sales commissions.

In the past, MicroStrategy announcing that it would be investing in Bitcoin was a signal of macro tailwinds and would drive surges of buying pressure.

In the Q&A portion of a Q4 2020 call, when asked if MicroStrategy planned to diversify from Bitcoin, Saylor said “Our view is that Bitcoin is an institutional-grade treasury reserve asset. It’s 95% dominant as a proof of work crypto asset network. That makes it the crypto asset winner if the use case is money or long-term store of value, i.e., digital gold. So what we wanted with our treasury was, in essence, digital gold from the dominant monetary network in the world.”

Saylor said that other cryptocurrencies did not align fully with that strategy – describing them as “investment theses” instead. “They are more like venture capital investments,” he said, “and they have a different risk-reward profile. We don’t have a portion of our treasury allocated to venture capital, so it wouldn’t be appropriate for us.”

Speaking to Andrew Henderson of Nomad Capitalist on January 28th, Saylor even prosphesized that Bitcoin will eventually take over from gold as the world’s primary reserve asset. “Gold is dead money,” he said. “Sell your gold, buy Bitcoin because other people are going to sell their gold and if you wait until you’ve been front-run by all the hedge funds when they dump their gold, you’re going to be the last person out. There’s $10 trillion worth of monetary energy in gold right now. Eventually, it will only be the central banks that will want to hold it. Every private rational actor is going to move out of it and move into Bitcoin.”

Who is Michael Saylor?

So who is MicroStrategy Executive Chairman and Bitcoin evangelist Michael Saylor? Saylor attended the Massachusetts Institute of Technology and graduated in 1987 with a double major in science, technology, and society, and aeronautics and astronautics. It was at MIT that Saylor met his MicroStrategy co-founder Sanju Bansal. After graduation, Saylor spent two years as a computer simulation consultant for The Federal Group and Dupont before he and Bansal launched MicroStrategy in 1989. The company’s core business as a software vendor is enterprise business intelligence (BI) applications. The MicroStrategy platform supports interactive dashboards, formatted reports, scorecards, and ad hoc queries – all designed to help businesses make more informed decisions using their data.Michael Saylor purchased the url Hope.com – which now redirects to a MicroStrategy page extolling Bitcoin

In 1992 the company inked a $10 million deal with McDonald’s as its first major client and it never looked back from there. Today MicroStrategy has over 4000 customers in both the public and private sector including Coca-Cola, Johnson & Johnson, and Starbucks. It is listed on the NASDAQ (MSTR) and trades on its Global Select Market (Nasdaq-GS) tier. MSTR’s market capitalization is $9.16 billion and the company reports high renewal rates from blue-chip SAAS customers and continued high recurring revenue from license and support services.

Saylor has led the company through accusations of accounting fraud, a recent string of executive resignations, and numerous volatile trends in the software industry – but by any measure, MicroStrategy today is a bona fide success story and the largest independent publicly-traded business intelligence company.

Saylor stepped aside from his CEO position on August 8, 2022, which many attribute to shareholder concerns around his single-minded focus on Bitcoin. At the time Phong Le, the company’s President, became CEO and as a member of the Board of Directors. Nonetheless, Saylor remained the Chairman of the Board of Directors and an executive officer of the Company.

MicroStrategy buys Bitcoin

Saylor holds around 24% of MicroStrategy’s shares but controls 72% of the company’s voting power through a class of shares that gives him additional votes. Beginning in the summer of 2020 his personal obsession with Bitcoin crossed over into his corporate life, and Saylor has led MicroStrategy in becoming the most ‘pro-Bitcoin’ public company ever.

On August 11th the company completed its initial purchase of 21,454 BTC at a total aggregate purchase price of $250 million (average per Bitcoin= ~ $11653). This purchase was followed by a buy of 16,796 BTC for $175 million (average price per Bitcoin=~ $10419) in September 2020. Next, on the 5th of December, Saylor tweeted that the company had just made its third Bitcoin purchase – confirming a purchase of 2,574 BTC for $50 million in cash (average price per Bitcoin= ~ $19427).

Then, Saylor announced by tweet on the 21st of December, that MicroStrategy had just made a huge purchase of 29,646 Bitcoins – bringing the company’s total holdings to 70,470 Bitcoin. This purchase was funded by a convertible note sale to accredited investors which raised $650 million in early December. On February 24th the company announced that it purchased another 19,452 Bitcoin, worth around $1.03 billion. Following this major purchase, the company spent another $80 million on Bitcoin in a series of smaller BTC buys.

Why is Michael Saylor so bullish on Bitcoin?

So why is Saylor such a Bitcoin bull? “This investment reflects our belief that Bitcoin, as the world’s most widely adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash,” Saylor said after Bitcoin became MicroStrategy’s primary reserve asset.

Bitcoin also clearly appeals to Saylor’s identity as a tech evangelist. In September 2020 he tweeted prophetically, “Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.” This is still the pinned tweet on his Twitter account. Other oracular musings he has made about Bitcoin endorse it as;

- A decentralized 24/7 financial transfer market – “Over the Thanksgiving holiday weekend, #Bitcoin operated uninterrupted for 113.5 hours vs. 3.5 hours for US capital markets. Networks from Google, Apple, Facebook, & Amazon also operated uninterrupted. No one is going to settle for 3.1% availability from their monetary network.”

- A commodity that will become key to an industry – “ The same logic that compels engineers to prefer steel, aluminum, & oxygen for building, flying, & breathing leads me to prefer #Bitcoin for saving.”

- A boosted version of gold that speedily delivers financial freedom for investors – “#Gold delivers financial freedom via horse, buggy, & stagecoach. #Bitcoin is a crypto-powered warp drive. When the monetary mass transit system of the modern state breaks down, we might go back to an economy powered by horses, donkeys & mules, but I doubt it.”

Traditional finance reacts to MicroStrategy’s Bitcoin investments

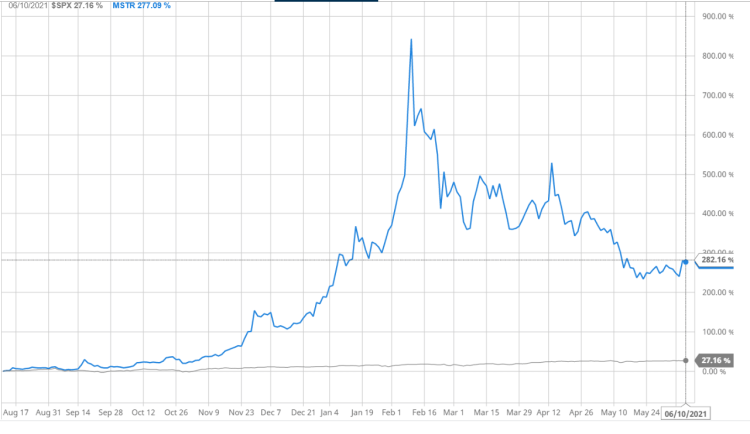

After its initial Bitcoin purchase in August 2020, the MicroStrategy stock price soared. On February 16th 2021, for example, the MSTR price was over $950, a high not seen since 1998. Today the price has slid significantly to $672, but remains up 360% since MicroStrategy made its first Bitcoin buy.

Analysts have complimented the MSTR stock opportunity as a successful software and analytics business that comes packaged with a treasury strategy that may be attractive to the Bitcoin curious. Citron Research said of MicroStrategy stock, “investors are getting a best in class software business at a discount and a free call option on owning a growing treasure chest of Bitcoins.” The research group also suggested that the only “safe and cost-effective way” to get exposure to Bitcoin was through MicroStrategy.

Russell Investments, an investment solutions and market index builder based in Seattle, bought 60,546 MSTR shares on September 30th 2020. This increased its position in MicroStrategy by ~72%. The company had previously endorsed Bitcoin in a 2018 blog which begins “While many are questioning Bitcoin’s foundations, perhaps even more importantly, Bitcoin is questioning the foundations of the central banks.” It goes on to say “Bitcoin is technologically exciting, can sustain a ‘new era’, ‘currency-of-the-future’ interpretation, and has the advantages of being both disparaged and underheld by a skeptical establishment.”

Quant focused hedge fund Renaissance Technologies has also been a major buyer of MSTR in the last six months. The firm has upped its MSTR position by 4x since June and analyst Ryan Todd suggested that the purchasing spree may have begun in response to MicroStrategy’s CFO remarking in a June 28th earnings call that the firm may allocate part of its treasury into Bitcoin.

The largest holder of MicroStrategy’s shares is BlackRock Fund Advisors – which is also the world’s largest asset manager. The firm has reduced its number of shares in MicroStrategy by ~5% this year – but still maintains a 14.79% stake in the company. Blackrock’s CEO Larry Fink said on December 1st that Bitcoin has “caught the attention” of many and that the nascent cryptocurrency asset class can possibly “evolve” into a global market asset in the future.

MicroStrategy’s first major Bitcoin purchase in 2020 snapped the company out of three years of sideways and downward price movement. As Ryan Watkins, a researcher at Crypto data firm Messari, aptly summarized on Twitter “MicroStrategy the past four months: A boring enterprise software company –> A boring enterprise software company with innovative treasury management –> A yolo levered long Bitcoin fund.” In 2020 and 2021, the MicroStrategy share price reacted positively to the company’s Bitcoin purchases – far exceeding the S&P’s modest gains during the same period.

In 2020 and 2021, the MicroStrategy share price reacted positively to the company’s Bitcoin purchases – far exceeding the S&P’s modest gains during the same period.