Bitcoin is back above $71,000 and currently sits at $71,346. Sentiment has once again flipped bullish, with growing anticipation that Bitcoin might finally be preparing to break through $73,000 and push on to new highs.

Huge ETF Flows

One catalyst for the strong price action was a huge ETF inflow on Tuesday. U.S.-based spot Bitcoin exchange-traded funds recorded their second-highest net inflow day ever, with $886.6 million. The Fidelity Wise Origin Bitcoin Fund (FBTC) led with the highest inflow of $378.7 million, followed by BlackRock’s iShares Bitcoin Trust (IBIT) with $274.4 million. The ARK 21Shares Bitcoin ETF (ARKB) also performed strongly, securing $138.7 million in net inflows. Even the Grayscale Bitcoin Trust (GBTC) experienced a notable inflow day with $28.2 million, one of only seven such days since its conversion to a spot ETF in January.

Source: X

Tuesday was the best day of ETF inflows since March and the second-highest overall since the eleven Bitcoin ETFs went live in January. Inflow activity has picked up recently amid a generally bullish sentiment after a dismal few weeks from mid-April to early May, a period that saw zero net inflows on some days and even outflows from major ETFs such as BlackRock’s IBIT. The higher activity comes a few weeks after the Ether (ETH) spot ETF got approved for listing in the U.S. and a positive outlook for cryptocurrencies from the U.S. presidential campaign.

Franklin Templeton CEO Jenny Johnson said this week that the current Bitcoin investment cycle is still in its nascent stages, with significant institutional money yet to be invested. “We are currently seeing the first wave of early adopters. I anticipate the next wave will involve much larger institutions,” Johnson explained during a recent CNBC interview. She predicts growing institutional interest as more investors and fund managers become comfortable with digital assets and their underlying technologies. Johnson, who heads the $1.6-trillion asset management firm, is a strong advocate for blockchain innovation. She foresees a future where all exchange-traded funds and mutual funds operate on blockchain technology due to its cost-efficiency in data processing and its potential for new applications.

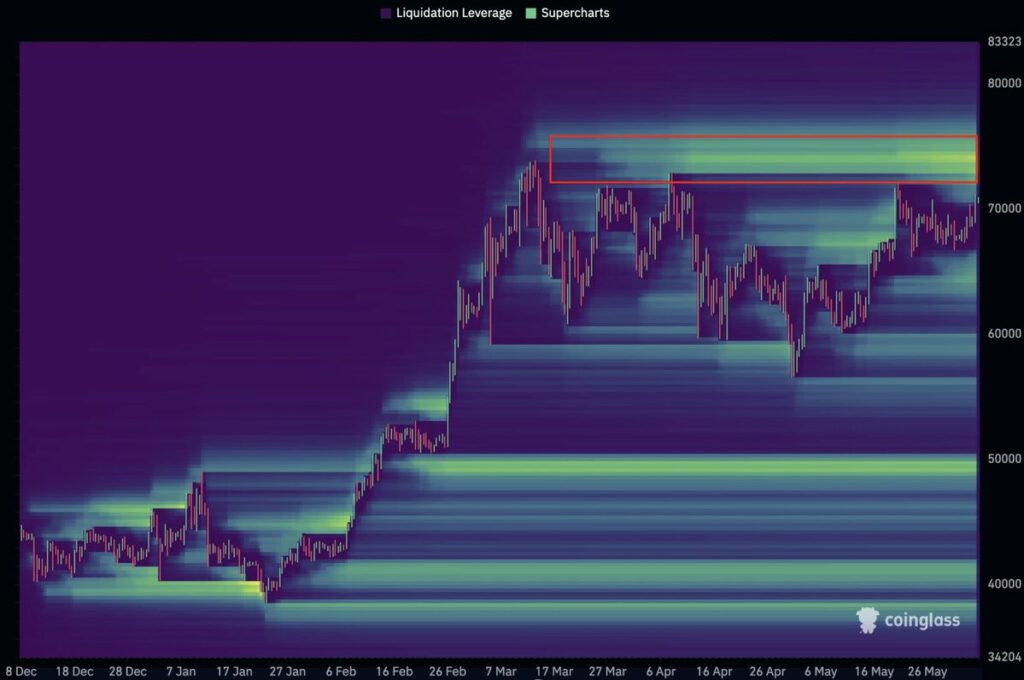

Analyst Material Indicators wrote on X that there remains significance resistance between the current spot price and the all-time highs at $73,800. Bidders were placing liquidity above $69,000 — a critical level to flip to support — to buoy BTC price. “Time will tell if it’s enough to keep price elevated above the R/S Flip line,” they wrote. “Meanwhile, ask liquidity is stacked above $71.5k and very dense around $72k. Some consolidation above $69k would be healthy. A wick below that line would invalidate the R/S Flip.”

If Bitcoin hits $72,000, it could serve as a catalyst to potentially break through the all-important $75,000 psychological barrier, wrote analyst Willy Woo on X. “Reaching $72k could trigger a cascade of liquidations. There are $1.5 billion in short positions poised to be liquidated, which could drive the price up to $75k and beyond, setting a new all-time high.”

Source: X

Marathon Mining Sells

Marathon Digital, one of the largest Bitcoin mining companies has sold over 60% of the Bitcoin (BTC) it mined since the halving event in late April, according to its monthly report. In May, the company sold 390 BTC, accounting for more than 63% of the 616 BTC it produced that month. As of May’s end, Marathon reported having $290.4 million in cash and cash equivalents. This significant BTC sale volume contrasts with other mining companies. For instance, Riot Platforms reported no BTC sales and produced 215 BTC in May, while CleanSpark mined 417 BTC but only sold 2.43 BTC.

The latest Bitcoin halving on April 20 halved the mining reward from 6.25 BTC to 3.125 BTC per block. Despite this reduction, Marathon managed to increase its block wins by 32% from April to May, resulting in 170 blocks won and mitigating the halving’s impact with only a 27% production decline, according to Marathon’s CEO Fred Thiel.

As rewards diminish, Bitcoin miners like CleanSpark are actively pursuing mergers and acquisitions, with upcoming expansions in Wyoming and other potential sites. Meanwhile, Marathon is expanding internationally, with recent initiatives including a partnership with Kenya’s Ministry of Energy and Petroleum to optimize renewable energy projects and a pilot project in Paraguay aimed at optimizing energy structures. Thiel highlighted an ambitious target for Marathon, aiming for 50% of revenues from overseas by 2028. Bitcoin mining operations also play a role in optimizing energy infrastructure, acting as flexible loads that help stabilize the grid. They can adjust their energy use based on grid demands, absorbing excess renewable energy when supply is plentiful and reducing consumption during peak periods.

The Mooch On Trump’s Crypto Pivot

Finally, Fortune has just published an op-ed by Anthony Scaramucci, founder and managing partner of SkyBridge Capital on Donald Trump’s pro-crypto stance and the upcoming November election. The Mooch recalls that during a recent rally, Trump made a direct appeal to his supporters, stating, “…if you are in favor of crypto, you better vote for Trump.” This statement not only highlighted his commitment to fostering the cryptocurrency sector but also established a clear dichotomy with President Joe Biden’s administration, which recently threatened to veto legislation that would ease some of the SEC’s stringent crypto regulations. This contrasting approach by Trump could sway a significant portion of the electorate, especially as crypto becomes an increasingly central issue in voter decision-making, says Scaramucci.

Polling data from DCG and The Harris Poll underscores the importance of crypto in the electoral discourse, particularly in battleground states where one in five voters sees crypto as a crucial issue. The article points out that both conservative and progressive voters find value in cryptocurrency — conservatives for its potential to enhance personal autonomy and progressives for its ability to diminish the influence of large banks and tech monopolies.

However, Scaramucci criticizes the current Democratic response to the growing interest in crypto. While some members of the party have begun to recognize its potential — evidenced by a few Democrats supporting the repeal of anti-crypto SEC guidelines and the FIT21 market structure bill — the overall stance remains cautious and, at times, opposed to the expansion of the crypto industry. This cautious approach, as noted by the author, risks alienating a vibrant, forward-thinking segment of the electorate that could be pivotal in tight races.

The piece concludes by stressing the urgency for Democrats to embrace the crypto movement fully. Trump’s enthusiastic endorsement of crypto at a recent gathering at Mar-a-Lago serves as a wake-up call: crypto and its predominantly young, tech-savvy base of supporters represent a potent electoral force. By aligning more closely with crypto’s innovative spirit, Democrats have a chance to capture this dynamic voter demographic, thereby safeguarding a key element of America’s future economic competitiveness. Failure to adapt could not only cost them the election but could also push the burgeoning digital asset industry — and its economic benefits — beyond U.S. shores.