MicroStrategy Inc. (MSTR) revealed third-quarter 2024 earnings, outlining a plan to raise $42 billion over three years to expand its Bitcoin reserves. This initiative highlights the company’s firm dedication to Bitcoin as its main treasury asset, strengthening its standing as the largest corporate Bitcoin holder globally.

Source: X

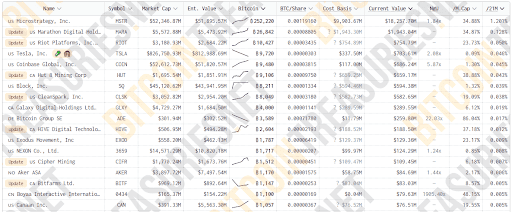

As of late October 2024, MicroStrategy boasts a substantial holding of 252,220 Bitcoins, with a market value soaring to $18 billion, according to Bitcoin Treasuries. The company has been aggressively expanding its Bitcoin reserves, acquiring an additional 25,889 Bitcoins since June 30, 2024, at an average price of $60,839 per Bitcoin, totaling $1.6 billion in purchases.

Source: Bitcoin Treasuries

MicroStrategy’s strategic accumulation aligns with the year-to-date appreciation of Bitcoin, significantly driven by the approval of Bitcoin exchange-traded products (ETPs), which have attracted considerable institutional interest. The introduction and initial success of spot Bitcoin ETPs signal Bitcoin’s maturation as an institutional-grade asset class.

“We believe the introduction and initial success at the spot Bitcoin ETPs evidences the maturation of Bitcoin as an institution-grade asset class, with broader regulatory recognition and institutional adoption,” a MicroStrategy spokesperson stated during the earnings call.

Strategic Capital Raising Enhances Bitcoin Treasury

In September, MicroStrategy advanced its position in capital markets, securing $1.1 billion through an equity offering and $1.01 billion via convertible senior notes maturing in 2028. This funding enabled the full repayment of $500 million in senior secured notes, leaving all Bitcoin holdings free from debt obligations.

Andrew Kang, Senior Executive Vice President and Chief Financial Officer, emphasized the critical role of recent funding efforts, noting the increasing alignment between MicroStrategy’s growth potential and its Bitcoin-centric strategy. He outlined the capital mechanisms supporting this approach, involving debt financing, equity issuance, and revenue from software operations.

MicroStrategy’s strategy combines equity and debt financing with cash flow from operations to build Bitcoin reserves. This treasury approach provides investors with diverse economic exposure to Bitcoin through equity and fixed-income options. Additionally, MicroStrategy delivers advanced AI-powered analytics software, blending technological growth with a commitment to digital assets.

Kang outlined the company’s leveraged Bitcoin acquisition model, identifying three main tools: debt financing, equity issuance, and software operation cash flow. By optimizing these market strategies, MicroStrategy intends to grow its Bitcoin portfolio, increasing shareholder value.

New 21-21 Plan Targets $42 Billion for Bitcoin Acquisition

MicroStrategy launched a bold 21-21 strategic plan to secure $42 billion in capital by 2027. The company aims to split this evenly, gathering $21 billion through equity and $21 billion in fixed income to expand its Bitcoin holdings. By implementing the largest ATM equity program ever, MicroStrategy plans to build a substantial Bitcoin reserve.

The roadmap sets a $10 billion target for 2025, split equally between equity and fixed income. This amount rises to $14 billion in 2026 and reaches $18 billion in 2027. A staggered schedule allows the company to balance interest costs effectively, switching between equity and debt funding as necessary.

Alongside this Bitcoin-focused approach, MicroStrategy continues enhancing its software segment, positioning itself as the leading independent public company in business intelligence. By Q3 2024, non-GAAP subscription billings grew 93% year-over-year, reaching $32.4 million—a fourth consecutive year of strong quarterly growth driven by cloud migrations and new customers.

Growth in cloud subscriptions highlights a successful pivot from on-premises to cloud services. While software revenue dipped by 10% to $116 million year-over-year, the focus on cloud is expected to yield more stable, recurring income. The company’s goal remains to increase cloud revenue through customer migrations while ensuring profitability.

Financial Performance and Future Outlook

MicroStrategy’s financials for Q3 2024 reflect a strategic balance between maintaining robust Bitcoin holdings and advancing its software business. While software business revenues saw a slight decline, subscription services revenues surged by 32% year-over-year, now constituting approximately 24% of total revenues, showing the company’s focus on building more robust, more sustainable cloud recurring revenues.

Cost of revenues increased by 29% compared to Q3 of the previous year, primarily due to higher cloud hosting costs associated with the growing cloud infrastructure. Operating expenses also rose by 7%, driven by higher stock-based compensation and custody fees related to increased Bitcoin holdings. Additionally, the company recognized $14 million in severance costs for workforce optimization, projecting a $30 million reduction in salary costs next year.

Andrew Kang emphasized the company’s disciplined approach to managing costs and optimizing organizational structures:

“This strategic planning across all departments in the company is focused on rightsizing overall staffing levels, optimizing organizational structures, and focusing on a disciplined performance management culture.”

CEO Michael Saylor Champions Bitcoin as Digital Capital

Michael J. Saylor, Chair, President, and Chief Executive Officer of MicroStrategy, passionately articulated the company’s vision during the earnings call. Comparing Bitcoin to traditional commodities like crude oil, Saylor highlighted Bitcoin’s role as a digital commodity with immense energy and value.

“Bitcoin is like the Facebook of money or the Google of money. It is the dominant digital monetary network,” he stated.

Saylor outlined MicroStrategy’s inventive financial tools, notably convertible bonds, designed to protect investors from losses while maximizing Bitcoin’s growth. Such instruments have achieved notable returns, surpassing Bitcoin itself. For instance, a $1 million investment in convertible bonds has yielded a 90% return, compared to Bitcoin’s 47% return over the same period.

MicroStrategy’s focus includes BTC yield, an essential metric that measures the shift in the ratio of total Bitcoin held to the assumed diluted shares. This figure evaluates the success of capital allocation strategies aimed at boosting Bitcoin reserves faster than share issuance. In 2024, the company reported a BTC yield of 17.8%, exceeding both the previous year’s rate and the company’s updated target of 6% to 10%.

Kang emphasized MicroStrategy’s strategic combination of operational strength, a dedicated Bitcoin reserve, and a commitment to technological advancement. This synergy positions the company at the forefront of digital assets and enterprise analytics.