Buffett found Munger to be truly honest

Warren Buffett said Charlie Munger was a trusted business partner, but he’s also been able to look elsewhere for personal support.

“I trust my children and my wife totally,” Buffett said. “But that doesn’t mean I ask them what stocks to buy.”

“In terms of managing money, there wasn’t anybody better in the world to talk to for many, many decades than Charlie,” he said. “That doesn’t mean I didn’t talk to other people.”

Still, “if I didn’t think I could do it myself, I wouldn’t have done it,” he said of business decision making. “So, to some extent, I talk to myself on investments.”

Buffett called Munger unfailingly honest, which is part of why he became a key companion. That applied to both his work and personal life, Buffett added.

“When you get that in your life, you cherish those people and you sort of forget about the rest,” he said.

— Alex Harring

Buffett says AI scamming could be next big ‘growth industry,’ likens technology to nuclear weapons

Warren Buffett said that artificial intelligence scamming could be the next big “growth industry,” likening the technology to nuclear weapons in its potential for great change.

The “Oracle of Omaha” said he doesn’t “know anything” about AI, but recounted a recent encounter with an AI-generated image of himself on screen that made him nervous about the technology.

“When you think about the potential for scamming people, if you can reproduce images that I can’t even tell, that say, ‘I need money,’ as your daughter, ‘I just had a car crash, I need $50,000 wired.’ I mean, scamming has always been part of the American scene, but this would make me, if I was interested in investing in scamming, it’s going to be the growth industry of all time,” he told a crowd of investors at Berkshire’s annual meeting.

“I said we let the genie out of the bottle when we developed nuclear weapons and that genie has been doing some terrible things lately, and the power of that genie is what, you know, scares the hell out of me,” he added. “And I don’t know any way to get the genie back in the bottle, and AI is somewhat similar.”

— Sarah Min

Geico is ‘still playing catchup’ with data analytics compared with its peers in the insurance sector, Ajit Jain says

Ajit Jain, Berkshire Hathaway’s vice chairman of insurance operations, is well aware that Geico is lagging behind its peers when it comes to data analytics.

“As Warren has pointed out in the past, one of the drawbacks that Geico is faced with is it hasn’t been doing as good of a job on matching rate with risk and segmenting and pricing product based on the risk characteristics. … Geico hasn’t been that good at managing risk,” Jain told Berkshire investors.

“Technology is something that is unfortunately been a bottleneck,” he said. “But then again, we are making progress. … Yes, I recognize we are still behind, we are taking steps to bridge the gap and certainly by the end of 2025, we should be along with the best of players when it comes to data analytics.”

— Brian Evans

Buffett accidentally refers to Greg Abel as Charlie Munger

In a slip-up, Buffett referred to Greg Abel, chair of Berkshire Hathaway Energy, as the late Charlie Munger.

“I’m so used to that,” Buffett said after the mix up.

The moment underscores the strength of Buffett’s relationship with Munger, who was viewed as a close friend and key business partner leading up to his death late last year.

Buffett admitted he would probably “slip again.”

“It’s a great honor,” said Abel, who is Buffett’s heir apparent, of being mistaken for Munger.

— Alex Harring

Buffett explains why Berkshire reduced its big Apple stake

When asked why Berkshire trimmed its Apple position, Buffett suggested it was for tax reasons following sizable gains on the investment and not any judgement of his long-term view of the stock.

He also suggested it could be tied to his view that tax rates may possibly be going higher to fund a ballooning U.S. fiscal deficit.

“It doesn’t bother me in the least to write that check — and I would really hope with all that America’s done for all of you, it shouldn’t bother you that we do it —and if I’m doing it at 21% this year and we’re doing it a little higher percentage later on, I don’t think you’ll actually mind the fact that we sold a little Apple this year,” Buffett said.

Apple shares over teh past five years.

Buffett said it’s “extremely likely” to Apple will remain the largest holding at his conglomerate despite the recent slowdown in sales.

The Oracle of Omaha said Berkshire will continue to own some of its top holdings — American Express, Apple and Coca Cola — when he’s no longer at the helm and Vice Chairman of Non-insurance Operations Greg Abel takes over. He added that Apple is an “even better business” than American Express and Coca Cola.

“That’s the story of why we own American Express, which is a wonderful business,” Buffett said. “We own Coca-Cola, which is a wonderful business. And we own Apple, which is an even better business, and we will own, unless something really extraordinary happens, we will own Apple and American Express and Coca-Cola.”

— Yun Li

Buffett found Japanese trading houses ‘compelling,’ but says bets in other countries ‘unlikely’

Warren Buffett finds his bet in Japanese trading houses “compelling,” but said he finds investments in other countries unlikely.

“We bought it as fast as we could,” the investor said in reference to five Japanese trading houses that he first acquired stakes in August 2020 on his 90th birthday, in an initial purchase worth roughly $6 billion.

It’s “unlikely we will make any large commitments in other countries,” he added.

— Sarah Min

Buffett says ‘fatal’ decisions have been avoided as Berkshire has saved over time

Warren Buffett said Berkshire has avoided making “fatal” choices in the several major decisions it faced over the years.

“Sometimes, we’ve done things that were big mistakes,” he said. “But we never get close to fatal mistakes.”

And “every now and then,” he said, they did something that “really works.”

Buffett also pointed to the company’s accumulation of $571 billion while avoiding those unfixable slip-ups, far ahead of runner-up JPMorgan. “This does show what can be done, really, without any miracles, if you save money over time,” he said,

— Alex Harring

Buffett says cash stake could reach $200 billion

Warren Buffett told Berkshire Hathaway investors on Saturday that the company’s cash stake could climb to $200 billion by the end of the current quarter.

“Our cash and Treasury bills were $182 billion at the quarter end, and I think it’s a fair assumption that they’ll probably be at about $200 billion at the end of this quarter,” Buffett said.

“We’d love to spend it, but we won’t spend it unless we think they’re doing something that has very little risk and can make us a lot of money,” he added.

— Brian Evans

Warren Buffett calls Charlie Munger the ‘architect of Berkshire’

Warren Buffett called Charlie Munger the “architect of Berkshire” at the conclusion of an emotionally moving, at times humorous, movie tribute to his long-time friend and business partner. Munger died last year at the age of 99, just weeks before his 100th birthday.

The short film detailed the life of Charlie Munger, including his life in Omaha, Nebraska, where he and Buffett were born and raised just two miles from the arena Berkshire’s annual meeting is held. It also showcased a montage of many of the short quips the investor had come to be known for over the years. At a 2015 meeting, he said: “Warren, if people weren’t so often wrong we wouldn’t be so rich.”

Many of the quotes are chronicled in CNBC’s Warren Buffett archive.

— Sarah Min

Charlie Munger’s book is the only one available at Berkshire this year

Charles Munger remembrance ahead of the Berkshire Hathaway Annual Shareholder Meeting at Omaha, Nebraska, on May 3, 2024.

Sarah Min | CNBC

About 2,400 copies of Charlie Munger’s book “Poor Charlie’s Almanack” were sold on Friday, Warren Buffett said.

The book is the only one being sold at the annual shareholders meeting this year, in honor of Munger following his death. In a typical year, Buffett said there would be around 25 books for sale.

— Alex Harring

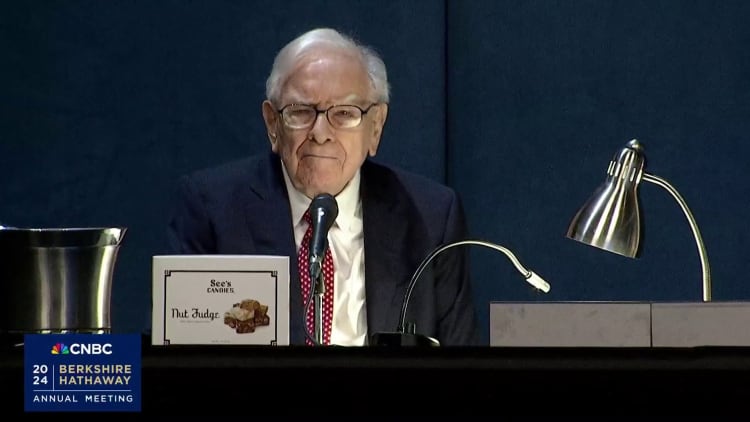

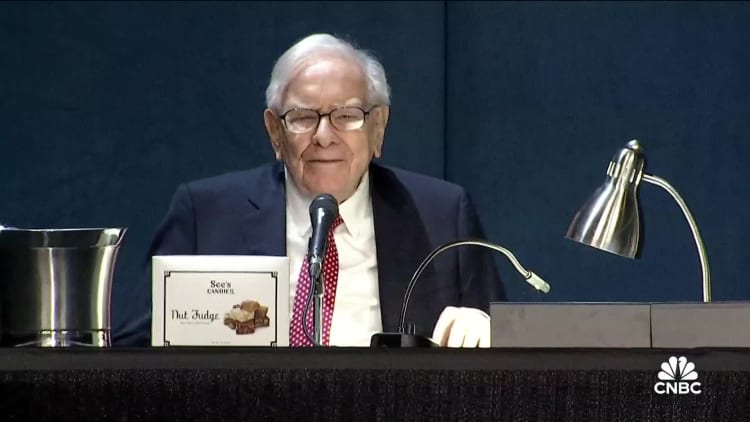

Warren Buffett takes the stage

Warren Buffett has taken the stage to begin the Berkshire Hathaway annual meeting.

Standing ovation for Munger

At the end of Berkshire annual meeting movie, Buffett asked the staff to turn on the lights in the arena for the late Charlie Munger. Some 30,000 shareholders in the room stood up to give Munger a standing ovation, paying their respects to Buffett’s business partner for more than 60 years.

— Yun Li

Charlie Munger tribute begins

Warren Buffett and Charlie Munger at Berkshire Hathaway shareholder meeting, April 30, 2022.

CNBC

This year, the short film that precedes the start of Berkshire Hathaway’s annual meeting was a tribute to Charlie Munger. Attendees laughed at a reel of the investor’s best-known zingers over the years, including “If people weren’t so often wrong, we wouldn’t be so rich.”

— Sarah Min

Ariel Investments CEO tells investors contemplating Berkshire shares to ‘just get started’

Ariel Investments CEO John Rogers called Berkshire Hathaway shares a top investment idea, while hedging that investors don’t need to jump in all at once when the price is high.

Rogers said it’s one of the best investments of all time. When shares are considered expensive, traders should use dollar-cost averaging to build a stake over time as opposed to buying in all at once, he said.

“I tell people all the time, ‘just get started,'” he said during CNBC’s Saturday stream from the annual shareholders meeting.

Rogers has been a shareholder for over two decades, but said he “really wished” he had started 40 years ago.

“I keep kicking myself, like, ‘How could I have missed that?'” he said.

— Alex Harring

Tim Cook present at annual meeting

Apple CEO Tim Cook is present at Berkshire’s annual meeting Saturday, sitting in one of the front rows with Luca Maestri, the iPhone maker’s chief financial officer, and Kristin Huguet Quayle, vice president of worldwide communications.

Cook has attended multiple Berkshire meetings in previous years.

Berkshire has been Apple’s biggest shareholder outside of exchange-traded fund providers. However, in the first quarter, the conglomerate did cut its gigantic stake by about 13%.

Cook told CNBC’s Becky Quick that the company feels “privileged” to have Berkshire as a shareholder.

— Yun Li, Steve Kovach

One analyst hopes for more insight into management bench at Berkshire

Warren Buffett poses with Martin, the Geico gecko, ahead of the Berkshire Hathaway Annual Shareholder’s Meeting in Omaha, Nebraska on May 3rd, 2024.

David A. Grogan | CNBC

Investors hope Warren Buffett will provide more insight into the next level of management at Berkshire Hathaway, after the passing of Charlie Munger brought the question of succession to the fore, one analyst said.

“Succession is quite frankly a top of mind issue for most investors. And it’s kind of like the elephant in the room given Warren Buffett’s age, given the passing of Charlie Munger,” said Cathy Seifert, senior vice president at CFRA Research.

“It’s my hope that Berkshire outlines or reassures investors that the management bench at the firm at the broader firm is deeper than perhaps what some people may perceive. I happen to think that there is a lot of talent a couple of rungs below the people we see sitting on the desk during the annual meeting,” Seifert added. “I think that Berkshire would do itself a favor to sort of maybe highlight some of those people.”

— Sarah Min

Berkshire Hathaway shares can get a boost from easing interest rates, analyst says

Berkshire Hathaway shares are beating the market this year, but they could further rally should the Federal Reserve cut interest rates given its mix of cyclical businesses, one analyst says.

“I think it’s safe to say that interest rates are stable,” said Cathy Seifert, senior vice president at CFRA Research. “And, in a stable-to-declining interest rate environment, a lot of Berkshire’s economically sensitive businesses should do reasonably well.”

CFRA’s Seifert has a buy rating on the company. Her 12-month price target of $472 implies Berkshire shares can climb roughly 18% from Thursday’s closing price of $400.60 per share.

— Sarah Min

Why did Berkshire trim its big Apple stake?

The gathering could be a chance for Buffett to explain why Berkshire has trimmed investments in his favorite stock Apple.

For the second quarter in a row, Berkshire’s Apple holdings have declined. In the fourth quarter, it sold about 10 million Apple shares (just 1% of its massive stake). Then, in the first quarter, it appears Berkshire sold another 116 million shares.

That’s based on the disclosure that Berkshire’s Apple stake is worth about $135.4 billion, which would be around 790 million shares, or a decline 13% in its investment.

Buffett’s sales have come as a surprise for some as he has grown to become such a big fan of the iPhone maker, even calling it his second-most important business after Berkshire’s cluster of insurers. Moreover, the last time Buffett trimmed this stake was in late 2020 and he called it “probably a mistake.”

The move could be prompted by valuation concerns. Apple rallied 48% in 2023, making up 50% of Berkshire’s portfolio at its peak.

— Yun Li

Berkshire Hathaway’s cash hoard swells to record $188.99 billion

Berkshire Hathaway continues to sit on a massive cash pile. Its first-quarter earnings report reveals cash equivalents climbed to $188.99 billion from $167.6 billion at the end of 2023.

Shareholders will be eager to hear how Warren Buffett and the rest of Berkshire management plan to put this money to use. Buffett has lamented in past years how troublesome it has been to find appropriate acquisition targets.

The increase in cash, comes as operating profit in the first quarter rose 39% to $11.22 billion from a year ago.

—Fred Imbert, Christina Cheddar Berk

Berkshire attendees line up bright and early

The CHI Health Center before the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 4, 2024.

Sarah Min | CNBC

It was a cold and drizzly morning in Omaha, where tens of thousands of attendees flocked to the CHI Health Center Omaha arena to hear Warren Buffett speak the 2024 Berkshire Hathaway shareholders meeting.

— Sarah Min

Buy ‘undervalued’ Berkshire Hathaway shares, says CFRA

CFRA is bullish on B shares of Berkshire Hathaway ahead of the company’s annual meeting.

The firm called the stock “undervalued versus historical averages” and anticipates catalysts in the Berkshire Hathaway’s earnings release Saturday morning.

Berkshire Hathaway’s class B shares over the past year.

Shares of Berkshire Hathaway are up nearly 13% year to date.

To read more about CFRA’s call and what it expects from CEO Warren Buffett during the so-called “Woodstock for Capitalists,” read the full story here.

— Michelle Fox

Time to reveal secret bank stock?

There’s a chance that Buffett will reveal the mystery wager Berkshire has been buying for two quarters straight.

In the third and fourth quarters of 2023, Berkshire was granted confidential treatment to keep the details of one or more of its stock holdings confidential.

Many speculated that the secret purchase could be a bank stock as the conglomerate’s cost basis for “banks, insurance, and finance” equity holdings jumped by $3.59 billion in the second half of last year, according to separate Berkshire filings.

It’s relatively rare for Berkshire to request such a treatment. The last time it kept a purchase confidential was when it bought Chevron and Verizon in 2020.

— Yun Li

First meeting without Charlie Munger

Warren Buffett walks the floor and meets with Berkshire Hathaway shareholders ahead of their annual meeting in Omaha, Nebraska on May 3rd, 2024.

David A. Grogan

The annual meeting could start on a somber note with the absence of Charlie Munger on everyone’s mind.

Pandemic lockdown apart, it will be the first without Munger, Buffett’s longtime partner who passed away in November at the age of 99.

For the first time, Berkshire will broadcast its annual meeting movie that had previously always been reserved only for those in attendance in Omaha. Many speculate this year’s will be a tear-jerker tribute to Munger.

Vice Chairman of Non-Insurance Operations Greg Abel, Buffett’s designated successor, will fill Munger’s seat in the afternoon session, helping answer shareholder questions.

Munger left a mark on generations of investors in a host of ways thanks to a long and fruitful life. He broadened Buffett’s investing approach to focus on quality companies selling at fair prices. Shareholders also appreciated Munger’s one-of-a-kind bluntness and humor.

— Yun Li

Here’s the schedule for CNBC’s coverage of the Berkshire Hathaway annual meeting

CNBC will be livestreaming Berkshire Hathaway’s annual shareholder meeting on Saturday, beginning at 9:30 a.m. ET. Viewers can expect a lively discussion that will provide insight into Warren Buffett’s view of the market, what types of deals Berkshire could make in the year ahead and other key topics.

Here is a rundown of the day’s events:

9:30 a.m. – 10:15 a.m.: Pre-show anchored by Becky Quick and Mike Santoli

10:15 a.m. – 1 p.m.: Berkshire Hathaway morning Q&A session

1 p.m. – 2 p.m.: Halftime show anchored by Becky Quick and Mike Santoli

2 p.m. – 4:00 p.m.: Afternoon Q&A session of annual meeting

4:00 p.m. – 4:30 p.m.: Post-show anchored by Becky Quick and Mike Santoli

Note: Schedule reflects Eastern Time

—Christina Cheddar Berk