Ondo Finance, a platform focused on tokenizing real-world assets, is bringing its $185 million U.S. Treasury-backed token to the XRP Ledger (XRPL), an enterprise-centric blockchain network. The move aims to expand institutional access to the offering, the companies announced on Tuesday.

The Ondo Short-Term US Government Treasuries (OUSG) token, backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), allows qualified investors to mint and redeem tokens almost instantly using Ripple’s RLUSD stablecoin.

According to a blog post by Ondo Finance, the deployment on XRPL is expected to go live within six months.

Both Ripple, a leading contributor to the XRP Ledger, and Ondo Finance have provided seed investments for initial liquidity on the XRPL. However, the size of these allocations remains undisclosed.

Good news for XRP, Tokenization is coming to the ledger, Source: X

Following the announcement, ONDO, the governance token of Ondo Finance, rose by 4%.

The tokenization of real-world assets (RWA), such as bonds, credit instruments, and investment funds, is rapidly transforming finance. By representing these traditional assets on blockchain, participants benefit from faster settlement times and improved efficiency compared to conventional financial systems.

Tokenized U.S. Treasury products have been at the forefront of this trend, growing fourfold over the past year to form a $3.5 billion market, according to data from rwa.xyz.

“The 24/7 intraday settlement enabled by tokenized assets like OUSG represents a transformative shift in capital flow management, freeing transactions from traditional market hours and slow settlement processes,” said Markus Infanger, Senior Vice President of RippleX, Ripple’s XRPL-focused division. “These high-quality, low-risk liquidity solutions provide better accessibility for investors and bring greater stability to blockchain-based markets.”

The XRPL and OUSG: Institutional Finance In Harmony

The announcement is good news for Ripple and XRP, as the XRP Ledger (XRPL) is purpose-built to meet the demands of traditional financial institutions. With over a decade of experience facilitating cross-border payments, digital asset custody, and stablecoin issuance, the XRPL provides a robust and proven foundation for real-world asset (RWA) tokenization and institutional decentralized finance (DeFi).

Key XRPL features like advanced compliance tools, such as decentralized identifiers (DIDs) and price oracles, combined with forthcoming innovations like Multi-Purpose Tokens (MPTs) and Permissioned Domains, enhance its infrastructure. This positions the XRPL as an ideal platform for tokenized US Treasuries, seamlessly aligning with OUSG’s value proposition and reinforcing the XRPL as a cornerstone for institutional-grade financial solutions.

By integrating OUSG with the XRPL, Ondo Finance delivers institutional-grade assets directly to the institutions, offering wide onchain accessibility. This integration transforms how institutions interact with tokenized assets, enabling efficient treasury management, portfolio optimization, and access to high-quality yield—all within a secure and decentralized environment. The XRPL bridges DeFi and traditional finance, driving the adoption of tokenized assets and revolutionizing institutional financial management.

Brad Garlinghouse Advocates for a U.S. digital Asset Reserve that Includes XRP

Meanwhile, more good news for XRP came this week, with Brad Garlinghouse, CEO of Ripple Labs, advocating for a U.S. digital asset reserve that includes a diverse range of tokens, rather than focusing solely on Bitcoin (BTC), XRP, or any single cryptocurrency.

“I own XRP, BTC, and ETH, along with a handful of others—we live in a multichain world,” Garlinghouse shared on X. “I’ve always pushed for a level playing field, not a one-token-versus-another mindset. If a government digital asset reserve is established, it should reflect the broader crypto industry, not just one token, whether that’s BTC, XRP, or anything else.”

Garlinghouse is pushing hard for an XRP Digital Asset Reserve, source: X

His comments follow U.S. President Donald Trump’s recent statement that his administration would explore the creation of a national digital asset stockpile, an idea he previously endorsed during his campaign for reelection.

The crypto market speculates that such a reserve would likely include Bitcoin, the most widely adopted cryptocurrency with significant institutional support. However, traders on the decentralized betting platform Polymarket currently assign only a 17% probability to Trump approving the project within the first 100 days of his administration.

Garlinghouse firmly opposes Bitcoin maximalism, which promotes BTC as the sole candidate for such a reserve.

“Maximalism is the true enemy of crypto progress,” he said. “It’s encouraging to see fewer people adhering to this outdated and misinformed ideology.”

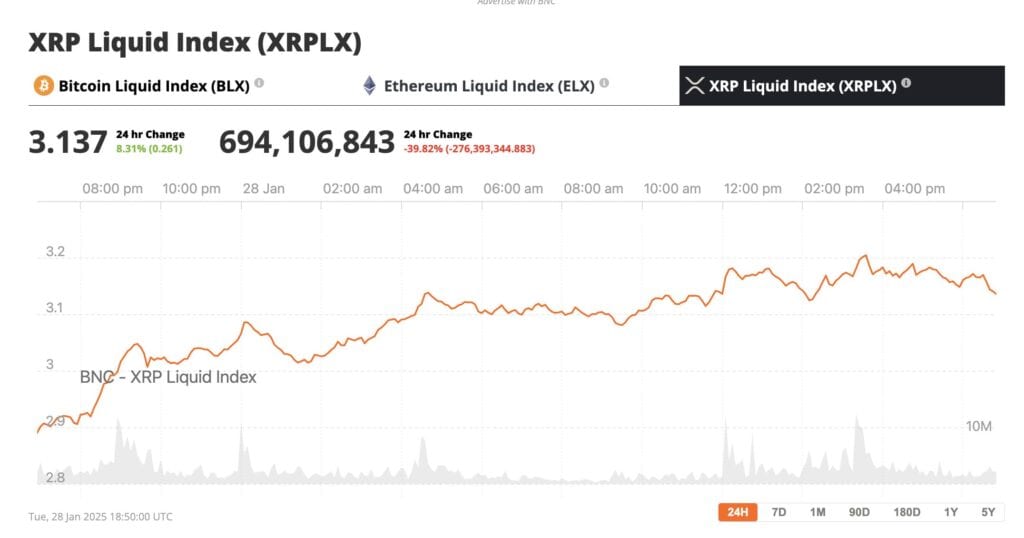

Ripple employs XRP to streamline cross-border payments and remittances. At the time of reporting, XRP was trading at $3.13 but experienced a sharp drop of nearly 10% to $2.64 on Monday, during the DeepSeek crash according to BNC data.

XRP is up 8% overnight, Source: XRPLX

How High Can The XRP Price Go in 2025?

XRP is showing signs of significant upward momentum, breaking out of key technical patterns that suggest a rally toward $4 in the short term. Here are our XRP price predictions for this year.

Bull Flag Breakout Targets $4

- XRP recently surged past a major resistance level, confirming a bull flag breakout on the 4-hour chart.

- Bull flags are bullish continuation patterns, and XRP’s breakout hints at further upside, with $4.00 as the next target, representing a 28% increase from current levels.

- However, failure to sustain the breakout could see a retest of $2.75, aligning with the 200-4H exponential moving average (EMA).

Long-Term Potential: $14 by 2025?

- XRP is also breaking out of a bull pennant pattern on the weekly chart, pointing to a massive rally toward $14.45 by 2025.

- Key Fibonacci levels:

- $4.82 (2.618 extension)

- $8.39 (4.618 extension)

- Full breakout target: $14.45

Fundamentals Support Bullish Outlook

The following chart by technical analyst Yovel, shows XRP forming a Bullish flag pattern in the 4H chart, on the verge of a breakout.

XRP is primed for another big move-up, Source: X